Payday loans, often known as cash advance loans, are little loans provided by private businesses. These payday loans are repaid by the borrower with their next paycheck.

Because many payday lenders have lax qualification requirements and don’t do credit checks, payday loan app is sometimes alluring to borrowers with bad credit or who urgently need cash. Payday loans can have very high-interest rates and a lot of costs, so you should be aware that they could be seen as a kind of predatory lending.

Payday loans may be challenging to pay back due to these fees, which might keep you in a debt cycle. A personal loan for those with weak credit is preferable to a payday loan.

How Are Payday Loans Applied?

With a payday loan, you consent to a short payback term, usually no more than two weeks. The amount you are borrowing plus the financing fee from the firm may need a personal check. A contract permitting the lender to cash the cheque on a certain date will also be required of you. As an alternative, you may pay off the loan in full with cash or pay an extra financing fee to extend the repayment period by another week.

You may make numerous loans and repayments at once with certain payday lenders. Payday loans may be obtained offline or online in the majority of states. In the following states and federal districts, payday loans are not permitted:

- Arizona

- Arkansas

- District of Columbia

- Georgia

- New Mexico

- North Carolina

Other states have regulations that specify the maximum loan amount and the bare minimum in terms of payback. Some states don’t have laws or rules governing payday loans. You may speak with the office of your state’s attorney general for further details about the laws governing payday loans in your area.

What Is the Cost of a Payday Loan?

The cost of a payday loan varies depending on a variety of variables, including the rates, fees, and state rules of the payday loan provider. The most costs that a payday loan provider may impose are capped in several areas. For each $100 you borrow, these costs, which normally run from $10 to $30, apply. According to the Consumer Financial Protection Bureau, an annual percentage rate of almost 400 percent is equal to a cost of $15 for every $100 borrowed (CFPB).

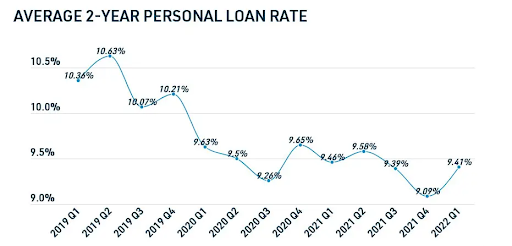

Payday loans are more costly than credit cards or even personal loans. According to statistics from the Federal Reserve, the average APR for a credit card was 16.17 percent as of February 2022, while the average APR for a 24-month personal loan was 9.41 percent.

People with low incomes may have issues with payday loans since it’s simple to accumulate more debt. If you don’t repay the whole amount owed, interest and a loan fee are added to the balance to renew the debt. The amount you have to return over a period of time might easily double or treble, adding up to more than the whole amount you borrowed.

Does Paying Back a Payday Loan Enhance Your Credit?

The short answer is No. Due to the fact that they don’t function in the same manner as a regular personal loan or credit card, payday loans won’t assist you in establishing credit. Your credit score won’t be boosted by on-time payments since most payday loan providers won’t disclose them to the credit bureaus.

When you apply for a payday loan, many lenders won’t verify your credit, so they won’t have access to your score. Your credit score will suffer if they send your bill to collections if you don’t pay your bills on time or pay them late.

Substitutes for Payday Loans

As anyone who has ever been in a tight spot financially knows, there are a lot of options to consider when you need money fast. Payday loans are one option, but they are not always the best choice. Here’s why: payday loans are expensive, and they don’t help you build credit.

The average annual percentage rate (APR) for a payday loan is 400%, which is much higher than the APRs for other types of loans. And because payday loans are unsecured, they don’t help you build credit history. So, if you need money fast, what are some better options? Here are some more advantageous choices to take into account if you need money to pay unforeseen bills.

Individual Loans

Both borrowers with good credit and borrowers with weak credit may benefit from personal loans. Even while your interest rate can be greater if your credit is less than perfect, it won’t be nearly as expensive as a payday loan. Rates that are substantially lower than those of a payday loan are frequently available.

Personal loans might help you pay for an unexpected need or combine the high-interest debt into one low monthly payment. Personal loans are available online or over the phone, and the majority of lenders will transfer the money into your account within a few days of receiving your application. If your credit is questionable, you may be able to apply for a secured loan or add a cosigner with acceptable credit.

Ask Your Bank Or Credit Union

Even if a customer’s credit is less than ideal, some banks and credit unions may provide them with a modest loan. The benefit is that you’re sticking with the familiar corporation (and hopefully trust). Additionally, if you work with your present bank or credit union, money may be placed into your account much more quickly than if you work with another lender.

If you enroll in automatic payments, credit unions and banks could charge less (or not at all) and provide perks like lower interest rates. The need that you to have good to exceptional credit from certain banks and credit unions in order to be approved for a loan is a drawback.

Ask Relatives Or Friends For A Loan

It might be challenging to borrow money from relatives or friends. Your relationship may suffer if you owe money to someone you care about. Only borrow money from someone if you can swiftly pay them back.

The good news is that your credit score won’t be impacted since your relatives and friends won’t run a credit check. However, they won’t record the payments either, so there is no advantage to paying off the debt other than keeping your relationship happy.

If you borrow money from a friend or relative, think about creating your own contract with payback requirements. Both parties may feel more at ease if a formal agreement is created.